Historical Performance Data Justifies the Fee of Working With a Financial Advisor

There is a lot of negative sentiment in the media & social media about investment fees, how much financial advisors are paid and the investor’s reduced future value as a result. Investors and new investors with assets under $1M can be become skeptical about the level of financial advisory fees and may ask themselves “Why should I hire you or continue to pay you these fees to manage my money when I could do it myself through other options that are now available?”

It’s a fair question. With the myriad investing information available online and Robo Advisors like WealthSimple, Robadvisor and Questrade, a truly self-directed investor who obsessively follows the markets, doesn’t follow the herd, manages their financial emotions well and also enjoys creating financial projections would fare well, maybe.

The Theory of Fees Eroding a Portfolio

The non-advised investor may think that their portfolio starting with $360K of assets, annual contributions of $80K over a period of 15 years, and an annual compound rate of return of 8% equates to approximately $450K of cumulative management fees paid over this time period if the blended management fee is 1.5%.

The Flaw in this Theory

This is a common flawed assumption around fees eroding a portfolio – that long term annual compound rates of return are guaranteed to be achievable from the non-advised investor. Also, being able to diligently save the recommended amount each year is more of an ideal that can’t always be met.

The Value Our Fees Provide

One percent of the assets under our fees is essentially for behaviour management. Reaching your financial goals is a slow, boring process that takes time and discipline. An industry-leading study known as the “Dalbar Quantitative Analysis of Investor Behavior (QAIB)” has shown that investors consistently underperform the benchmark due to poor investor behavior. Working alongside a financial advisor can help you control what your brain sees and allow you to ignore the market and focus on the end goal. Behavioral advice against panic in falling markets and euphoria in soaring times is going to be worth multiples of one percent per year.

What is the Actual Cost?

Instead of looking at the cost of management fees, let’s look at the cost of NOT working with an advisor by using metrics backed up by studies and facts. Let’s consider a non-advised investor, assuming a 2.4% rate of a return, invests $10,000 a month between the ages of 35-65.

Now let’s compare these results with one of our actual client experiences with One Capital Management (OCM). On OCM’s balanced returns being 7.4% from 1996-2020, using our fee schedule that starts at 2% and goes down to 1% on assets over 5 million, this results in a 6.25% return after the accumulated management fees.

Vanguard, one of the world’s largest investment companies, conducted 15 years worth of extensive research on quantifying the value of relationship-oriented services such as wealth management. When certain best practices around portfolio construction, wealth management and behavioral coaching are followed, the results show on average a 3% increase in net returns. According to Vanguard, this is called the Advisor’s Alpha. Expectations differ for each client, so it’s important to understand this value won’t appear every year – the guidance of financial advisors will prove itself over the long term.

Fees vs Taxation

Your skepticism around the fees you pay within the portfolio constructed for you isn’t unwarranted. There are many fee structures for the management of stocks, bonds, mutual funds and ETF’s, so it’s important to ensure with your advisor that you are receiving the value for the fees you’re paying.

When it comes to taxation of different investments, physicians have the advantage of being able to use their professional corporations (PC’s) to invest their savings. This allows physicians to utilize the power of compounding, since paying personal tax before investing the funds isn’t necessary. An advantage of working with an advisor is that these PC held investments need to be carefully monitored for taxation, as any income is subject to being fully-taxable at the highest marginal rate.

Financial Advice Leads to Better Saving

In order to reach your financial goals, saving on a regular basis is just as important as your returns. Many investors credit their advisor on achieving better savings and investment habits. In 2019, the Investment Funds Institute of Canada (IFIC), commissioned the independent research firm, Pollara, to analyze impressions regarding fees paid for financial advice. This 2019 study found that 80% of the investors say their advisor helped them save. The research was conducted with 1,024 Canadian investors over 18 years old who make all or some of the decisions regarding investments in their household.

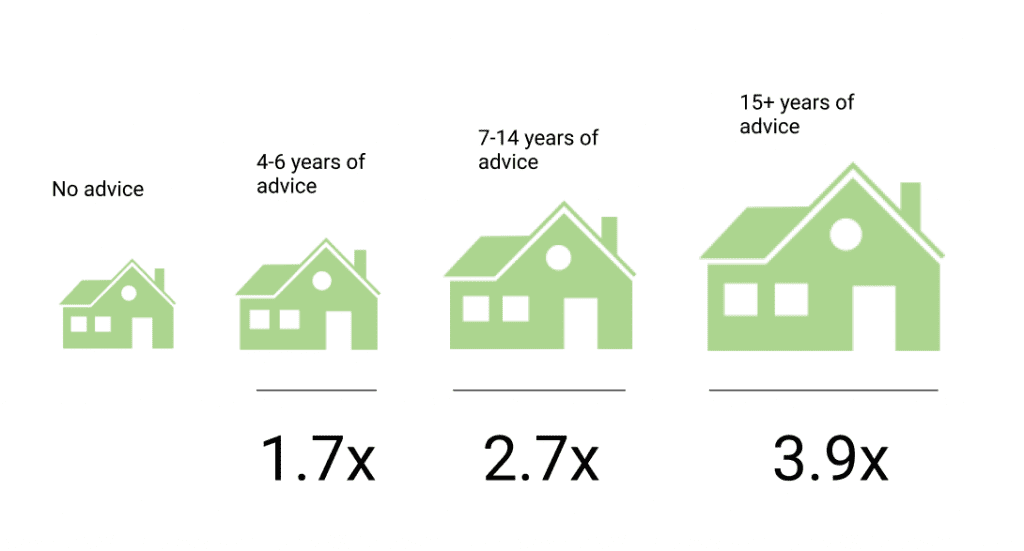

Results show those working with an advisor over a 15-year period have almost 4 times the assets of non-advised investors. And contrary to popular belief that advisors only work with the wealthy, the majority of Canadian investors featured in this report started with investable assets under $25,000 at the beginning of their advisory relationship.

Advised clients have a greater net worth over time

Robo Adviors

Usually it makes sense to use a Robo Advisor for accounts with less than $250K of assets. Robots are great at using software to automate the buying and selling of assets and can rebalance your portfolio over time but won’t be able to diagnose your personal financial problems and opportunities for improvement.

What we do:

Wherever you are in your investment journey, we can provide:

- Various financial solutions unique to your investment portfolio to accommodate your goals and risk tolerance

- A financial plan tailored to your situation that evolves with your life stages – there is no one size fits all plan.

- Comprehensive Financial Education to help you understand and gain confidence in your financial plan.

- Investment behaviour coaching to instill good saving and investing habits

- Other services beyond managing your investments, such as estate, wills and tax planning

Our Wealth Health Process

Our 6-Step Wealth Health Process ensures we execute maximum efficiency behind the scenes so you enjoy a seamless transition that is precisely curated to your specific needs and goals! Click the numbers below to view the process in more depth.

01

Initial Consultation

Meet the Team, allow pertinent information gathering, and exchange an overview of deliverables and expectations.

02

Financial Plan Recommendation

Our initial fact finding will allow us a clear vision of your goals so we can execute our expertise into building you your specific financial plan.

03

Recommendation Review Call

You've had time to review our suggested plan, did we miss anything, does anything seem unclear? Lets talk until it is!

04

Mutual Commitment

All parties are in agreeance about our objectives and goals. We can now transition you to the ClearWealth Team.

05

Plan Confirmation

Policies have returned, funds have moved, lets ensure it's aligned with our original goals.

06

Annual Financial Physical

Moving forward, we will perform an annual check-up on your finances to ensure your wealth is in great health!

So, is a Financial Advisor Worth It?

Your life savings require more attention than you can provide, and the research strongly points to the benefits of relationship oriented services like wealth management. Despite the overwhelming nature of investing, it’s important to see it for what it is: an effective tool that can be used to achieve your financial plan. Working alongside a professional advisor can help you articulate your goals and map out a clear path for reaching them.

Recent Comments